You know what they say about opinions….everyone has one. And while I’m full of them (my clients can vouch for this), I also try to base my opinions in data, facts, and on-the-ground experience.

While the data gives us general trend lines, I’m finding every home buyer and seller is experiencing their own unique version. There is a lot of variation within that trend line and patience and understanding are the keys to overcoming it.

With that, this market update will be less data centric, and more anecdotal and experience based. I would like to share with you the conversations I am having and the responses I’m seeing.

What I’m Seeing – Seller Mentality

Sellers are worn out. The constant parade of buyers coming to see their house is tough. If you’ve ever had to keep a home “show-ready”, you’ll understand. Every showing builds up their hope, and then they feel let down when nothing materializes.

A good chunk of buyers are looking for a killer deal. And if you aren’t willing to make a deal (and I don’t think you should if you are priced correctly) patience is the name of the game. In a typical market, where you may be on the market for 45-60 days and get 10 showings before a contract, today, you are still on the market for 45-60 days, but you’ve had 20 people look at your home.

Be kind to sellers, they are people, too. Yes, they do want to sell their home, but it is also a privilege to walk-through it. I don’t know about you, but my germaphobia would have my eyes twitching with that many people coming in my house. It’s no easy task.

What I’m Seeing – Buyer Mentality

Buyers are worn out. See the theme, here? If they didn’t lose optimism the last couple years, they are starting to now. There’s two topics I am noticing in my conversations with my buyers: 1) Thinking there is no room for negotiation, so why bother trying or 2) The market is going to crash, I’ll wait until then.

I’ve found there isn’t a lot of data I can share to change the opinion of group 2, but group 1 requires a little counseling. There is so much more to a deal than just sales price. There’s survey cost, loan programs, closing date, closing costs….the list really does go on.

I’ve also begun to feel like a bit of a magician when my loan officer partners offer up some of the phenomenal loan programs out there right now for purchasing a home. There are a lot of work-arounds in the form of down-payment assistance and interest rate buy-downs. Many buyers have not realized that and require a little coaching and a little eye-opening.

Hyper-Specific Markets

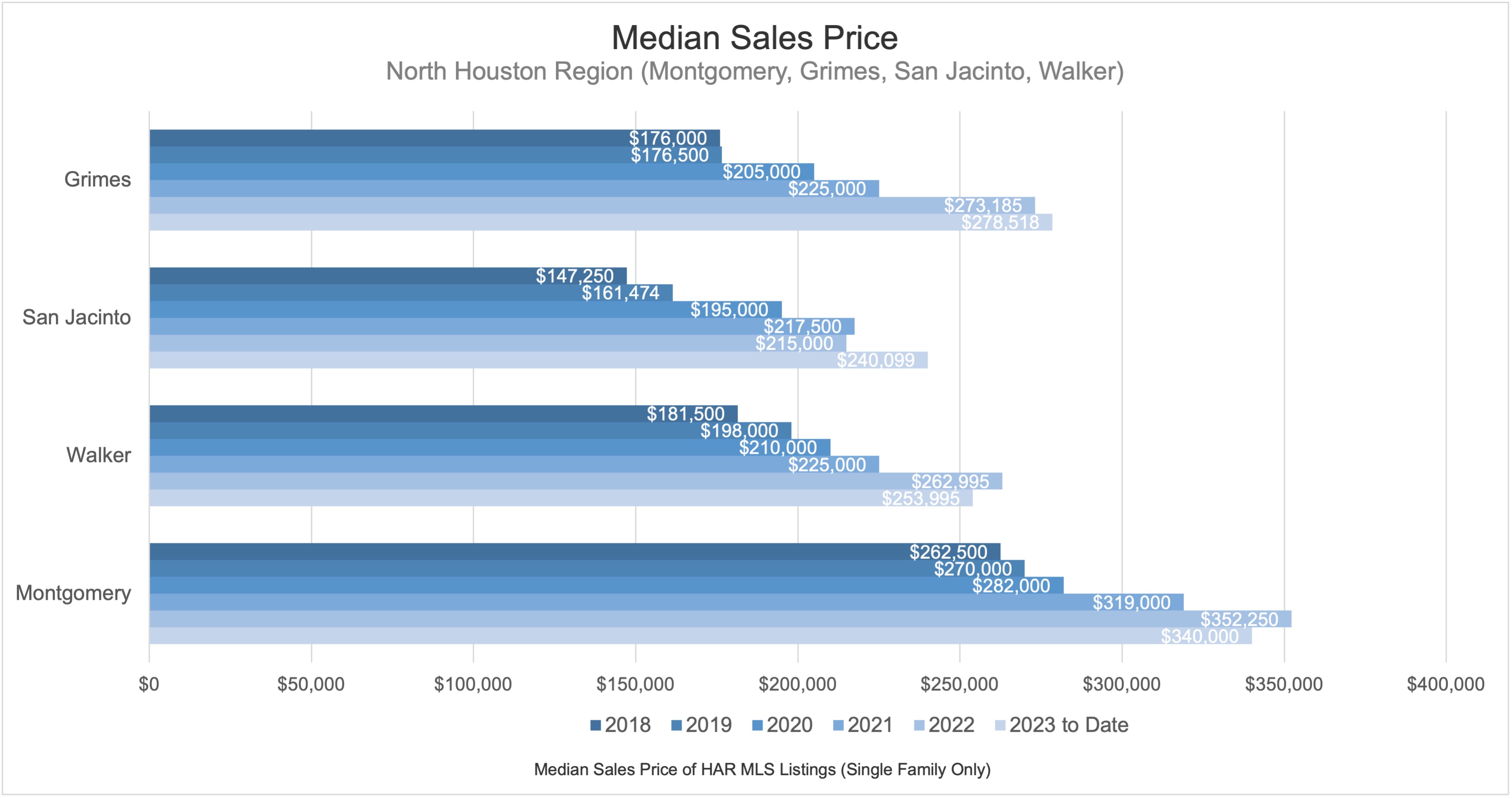

Different markets (region, city, and even neighborhood) are having varying experiences in the selling marketplace. Some have seen reduced demand and increased inventory, driving prices down. Others have continued to see bidding-wars and high demand. In my anecdotal experience, it seems to be centered around price-point and pricing strategy in our region.

The buyers are still out there, they didn’t just disappear or move to a different country. And they still very much would like to buy. However, current economic and market conditions have reduced their buying power, forcing them into the lower price brackets. For our area, this results in high demand for the $250k or less price point, with slowed demand over $350k. With the exception being large land tracts with development potential.

We also are seeing the areas with the highest price hikes during COVID, responding with the highest price reductions Post-COVID. I.e., The 2021 bidding wars driving prices $20k above asking price are now seeing prices stagnate in 2023. Far from a market crash, but noteworthy.

Perhaps most important of all, is pricing strategy. Overpriced homes chase the market down. Those who price right on, or just below, are leading the market and are often the first to sell.

Interest Rates Suck.

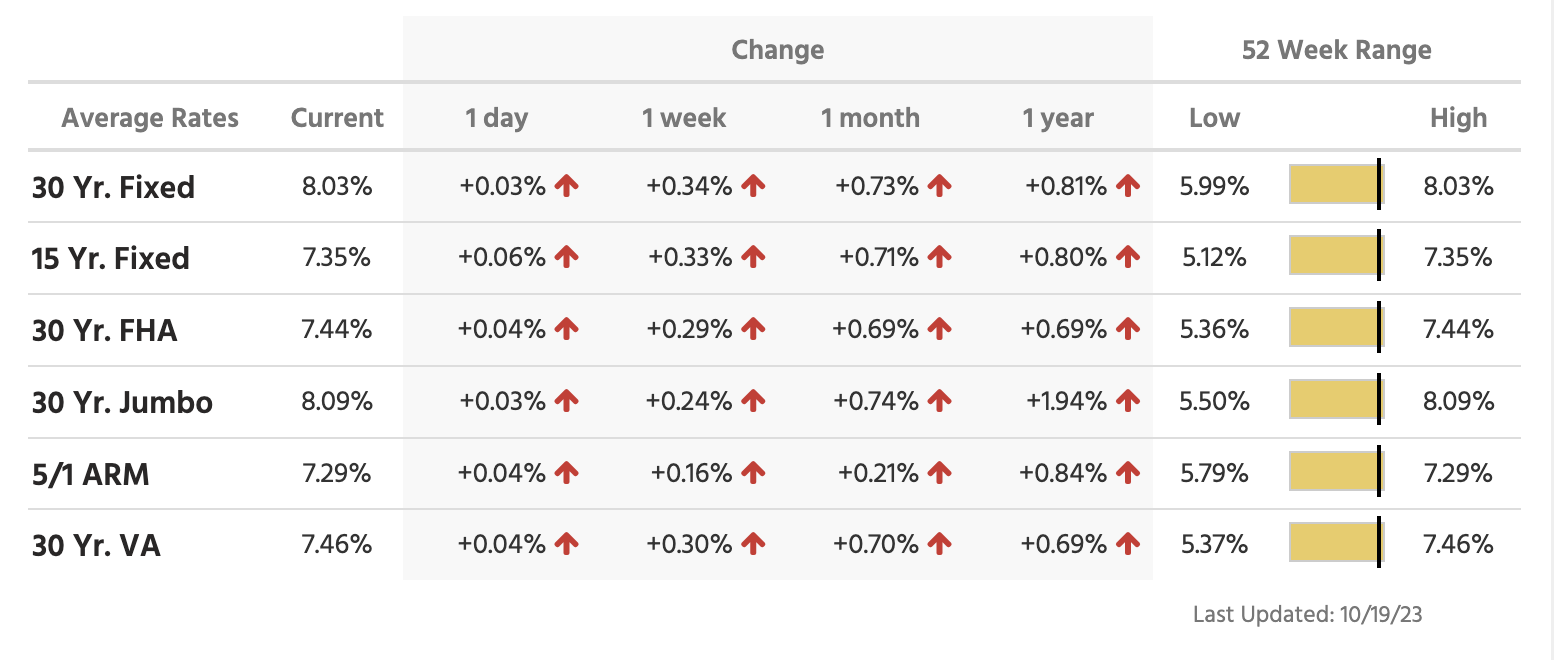

There, I said it. The constant barrage of negative news proclaiming “highest interest rates in a decade!” really puts a damper on home-buying dreams.

However, if you look beyond the flashy headlines, you’ll also notice in the same graph VA and FHA loans, both very popular options, are 0.5% lower in most instances. You’d also notice there are options to buy-down your rate. Either for the life of the loan, a stair-step program like a 2-1 buy-down, or any combination thereof. Worst case scenario, you can always refinance, if and when, it makes sense.

If you’re willing to look around the corner to what is coming, it’s not a bad time to buy. The current consensus is, when interest rates eventually come down, there will be a flood of buyers who come with them. Demand has not changed, buyers were sidelined.

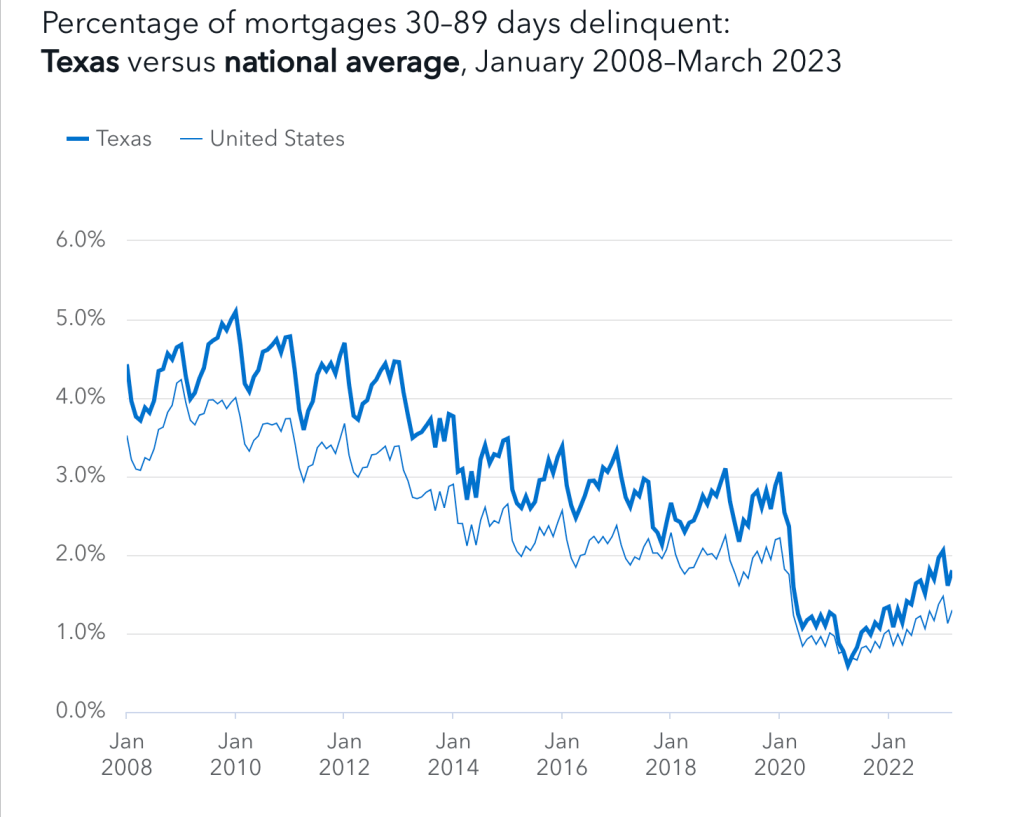

Housing Inventory

Part of the reason the current environment is so difficult is high home prices coupled with high interest rate. When demand outpaces supply, price will increase. It’s difficult to have a market crash with low housing supply. And with mortgage rate delinquencies and foreclosure at historic lows, well, you get the picture. The forecast is grim for a flood of houses becoming available anytime soon.

The more likely path to increasing supply will be for builders to make up the deficit. But with increased build costs and high interest rates on their loans, the incentive is not there for the small builders who don’t have the capital reserves to build and wait for a buyer. We have a bit of a pickle to sort out, as the Federal Reserve has alluded to many times.

Final Thoughts

The best deal is where both parties feel like they have won. Right now, this looks like a high level of cooperation, some compromise, and both parties remembering the other side is a human, too.

An interesting strategy some sellers have found success in is owner financing. It can be the win-win-win deal everyone is searching for. However, you must own the property outright and be willing to accept small payments over time in lieu of one large payout now. Adding a 3-,5-, or 7-yr balloon payment may be a good option for sellers who don’t want to service the loan in its entirety.

It’s never been a good time to fight against the other side, but it’s particularly true in the current environment. I’ve seen more deals come together with a little understanding from all sides than I ever have before. More than ever, you must be financially savvy and surround yourself with a team of experts. The finish line is not as far as you think.

Leave a comment