Happy Almost 2023! Although the latter half of 2022 may have been a bear for a multitude of reasons, there is light on the horizon. The 2023 housing forecast expects a minimal increase in sales prices and to relish in the fact that a market crash seems far from the picture.

Where We Are

Annual home sales are at their lowest level since 2014. High mortgage rates, general market uncertainty, and the high cost of market entry were significant barriers to buyers entering the market in the second half of 2022.

While news headlines like to blare emotional headlines warning of a market crash, let’s look at the facts for this housing cycle compared with the Great Recession.

| Key Variables | Great Recession Housing Cycle | Current Housing Cycle |

| Job Cuts, net gain or loss | Loss of 8 million | None |

| Total Payroll Jobs (W-2) | 130 Million | 153 Million |

| Total Jobs (Self-Reported Survey) | 138 Million | 158 Million |

| Subprime Loans | Prevalent | Virtually None |

| 5-yr Cumulative New Home Construction, units | 7.65 Million | 4.6 Million |

| Market Inventory, # of Homes | 3.8 – 4 Million | 1 – 1.2 Million |

| Mortgage Delinquency, % of total mortgages | 10.1% | 3.6% |

| Homes In Foreclosure, % of total mortgages | 4.6% | 0.6% |

| Source: Lawrence Yun, NAR Chief Economist. Analysis of BLS, Mortgage Bankers Assoc., and National Assoc. of REALTORS® data | ||

Across the board, key metrics like job cuts, mortgage delinquency rates, and foreclosure rates are significantly less. Couple that with a strong employment market, lack of subprime loans, and limited housing inventory, it’s hard to have the right recipe for a market crash. Instead, these market indicators point to a market that is still in desperate need of houses and will support reasonable and sustainable growth.

As of Mid-December, there are an increased (+38.1%) percentage of listings compared with December 2021; however, there are a decreased (-22.0%) number of new listings. This data indicates we have a lot of “stale” homes sitting on the market – those that are overpriced, lack updates, or may not qualify for traditional financing opportunities.

I mentioned 2 critical words above: Reasonable and Sustainable Growth. What we saw the last 2 years was anything but. We absolutely needed a market correction, which I believe we have gone/are going through. But with reduced new construction home starts and fewer new listings on the market, will we end up with an inventory issue again??

Mortgage Rates

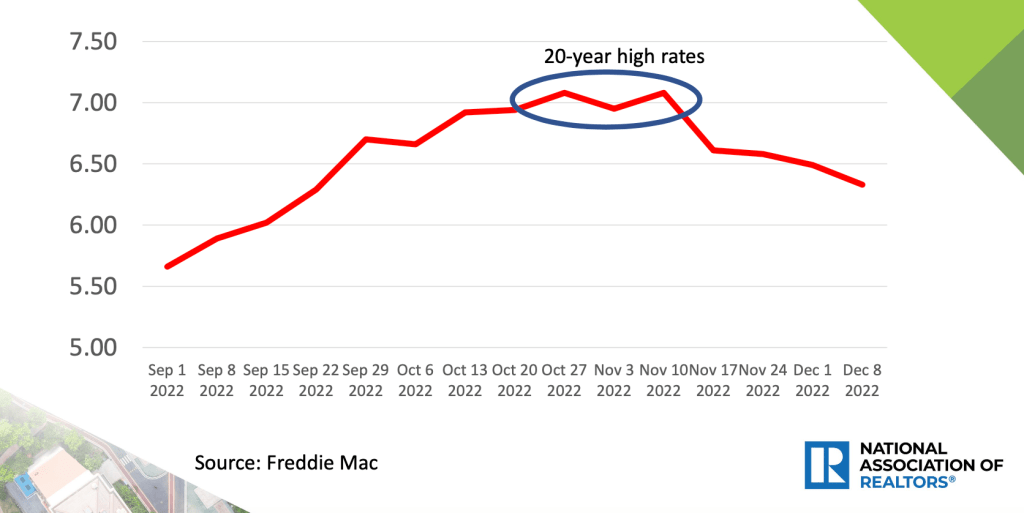

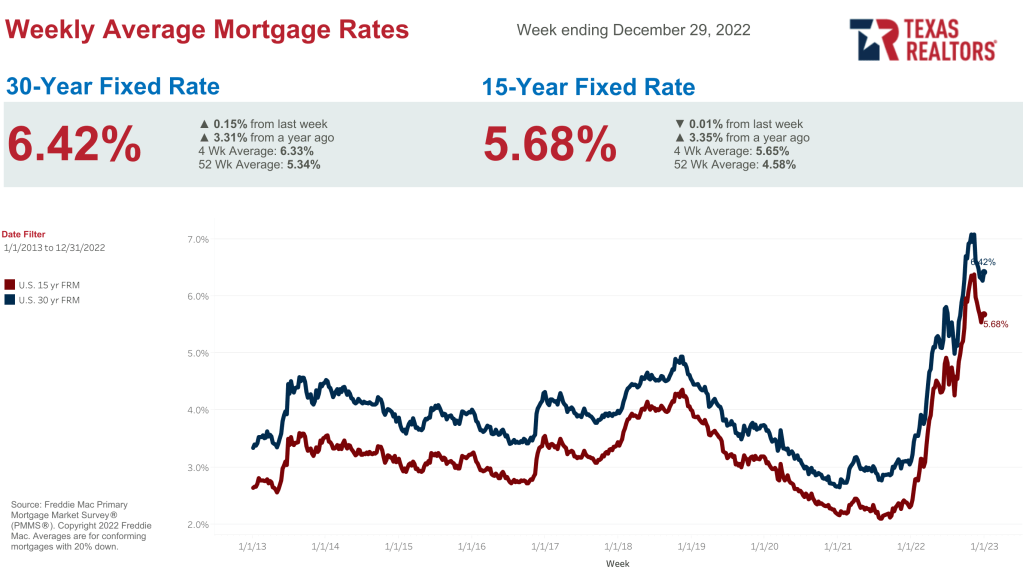

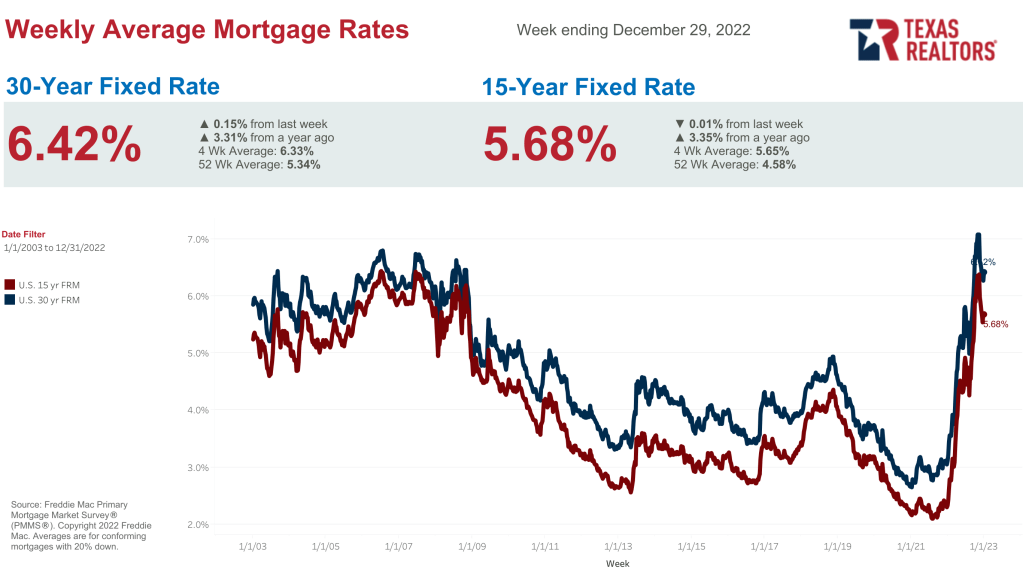

This topic deserves a special paragraph all to itself. To curb inflation, The Fed has been raising the Prime Rate. While this does not directly impact mortgage rates, mortgage investors look to The Fed’s actions for indicators on how safe/profitable they think mortgages will be in the future. When The Fed’s actions and commentary reflect their strategy is working and inflation is being reigned in, the mortgage market responds positively by reducing mortgage rates. You will see this reflected in the chart below.

You can see mortgage rates reached a 20-year high just a few months ago, edging just over 7%. Since then, they have come down to mid-6%’s with the opportunity for buy-down’s in most situations. Looking at the big picture of the last decade, rates are not much higher (within 1.5%) of what we have previously seen. Open that up to the last 20 years…and, well, you can see for yourself. We aren’t too far from the norm.

Where We Are Going

Let’s recap – we have a strong job market, low housing inventory, stabilizing mortgage rates…..where does that leave us? Price is a direct reflection of the relationship between supply and demand. We all know that.

So, with a reduced supply of homes, and sustained or even potentially increased demand, will we see price support, if not growth? Some experts think so. Here’s a summary chart of where we are expected to go compared with where we have been.

| Year | Unit Sales | Home Price |

| 2019 | 0.0% | +4.9% |

| 2020 | +5.6% | +9.1% |

| 2021 | +8.5% | +16.9% |

| 2022 Estimate | -16.2% | +9.6% |

| 2023 Forecast | -7% | +0% |

| 2024 Forecast | +10% | +5% |

| Source: Lawrence Yun, Chief Economist, National Association of REALTORS® | ||

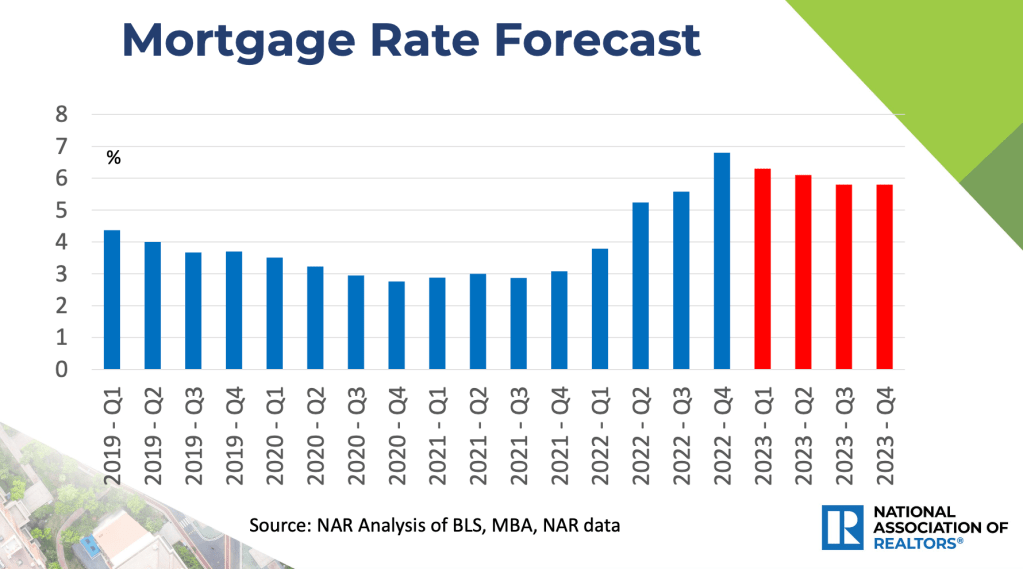

Furthermore, some mortgage experts are predicting we may see mid- to high-5’s for interest rates by Q3 of 2023. This may help to bolster demand as would-be buyers sidelined by the higher interest rates may come back into the market.

So, What?

Expect 2023 to bring similar prices to 2022, if not slightly reduced. For sellers, this may come in the form of a sales price reduction, contributions to buyer closing costs, or possibly repairs prior to closing. For buyers, your biggest hurdle is interest rates. Make sure to investigate interest rate buy-down’s as these can make a significant impact over the life of your mortgage.

I think the biggest takeaway I’d like you to have is this: It’s still a good market.

Seriously. The trick is to match your strategy and goals to the current conditions. As always, I’m happy to help you strategize on how to do that. I’ll be honest with you and sometimes say what you may not want to hear. But I will help you to move mountains if that is what you need.

If you’d like more advice and specific strategies, feel free to reach out or you can read more Here

Leave a comment